In 2024, a joint survey from the RAeS and digital manufacturing experts, Protolabs, revisited a 2023 questionnaire on the top concerns and issues for those in aerospace manufacturing. One year on, what were the fresh findings of this updated industry snapshot? TIM ROBINSON FRAeS reports.

One year on from the 2023 survey and events in Renton, Seattle have put aerospace manufacturing squarely in the spotlight – particularly relating to quality control, inspections and regulatory oversight. In addition, the previous twelve months have seen the civil aviation supply chain rocked by a ‘fake spare parts’ scandal, which saw airlines scramble to determine whether their aircraft were affected by bogus parts with falsified documentation.

Taken as a whole, that will likely mean more scrutiny on certification, digital paper trails and quality controls for suppliers and manufacturers. However, did these events shift the needle compared to last year’s survey? Let’s find out.

The 2024 survey saw 749 responses from RAeS members. ‘Engineers’ (37.62%) made up the majority of respondents in the 2024 survey, followed by ‘other’ at 19.28%, ‘retired’ at 17.14% and ‘students’ at 14.59%.

The Big Questions

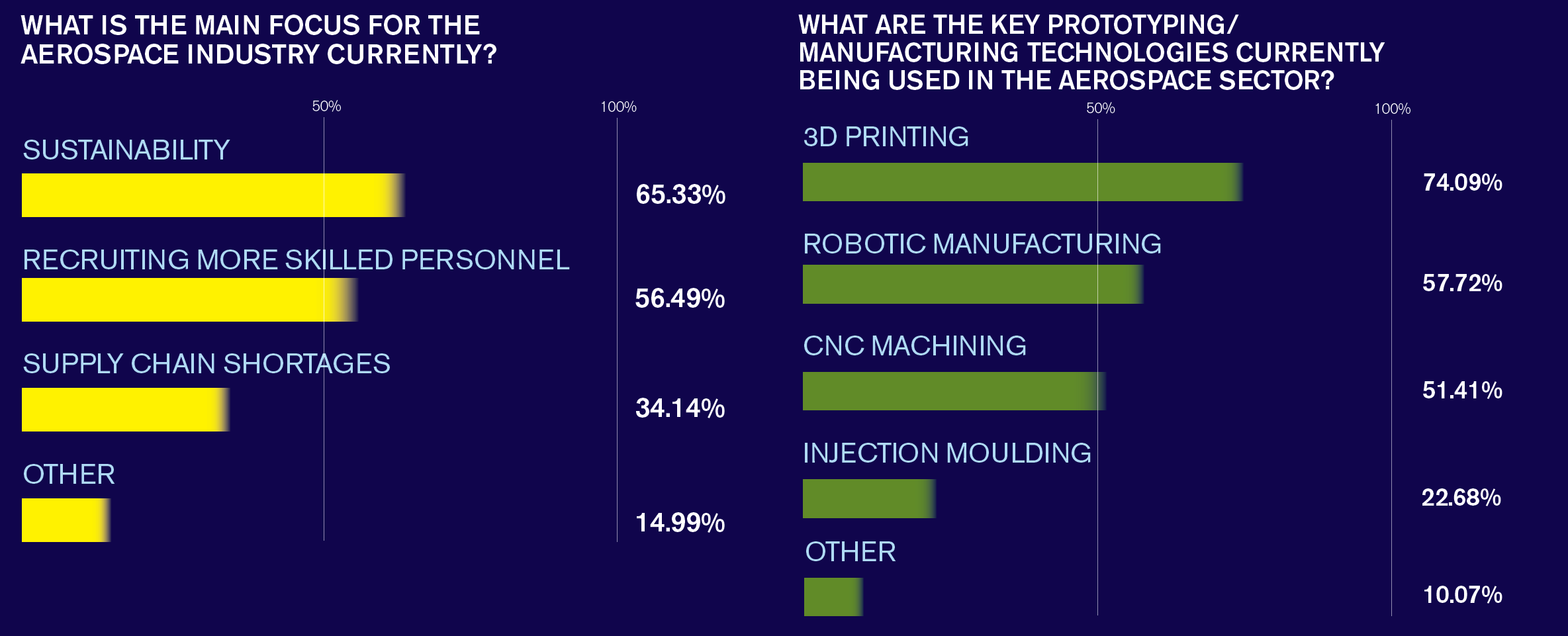

In 2023, the first multiple-choice question, which allowed respondents to tick all that applied – ‘What is the main focus for the aerospace industry currently?’ saw recruiting more skilled personnel (53%) narrowly edge out sustainability (51.3%) and supply chain shortages (50.7%).

In 2024, sustainability soared into a definitive lead with 65.33% of respondents choosing that as the top answer, followed by ‘recruiting more skilled personnel’ on 56.49%. Interestingly, supply chain shortages dropped to 34.14%, perhaps an indication that for those involved in aerospace manufacturing the worst of the supply chain crisis is now over.

Challenges and Opportunities

Meanwhile, the next question, on ‘What are the key prototyping/manufacturing technologies currently being used in the aerospace sector?’ also saw a shift in responses from a fairly even spread in 2023, where ‘CNC Machining’ (54%), 3D printing (51%) and robotic manufacturing (45%) were almost neck and neck with the 2024 results, where 3D printing emerged as the clear winner at 74.09%, followed by robotic manufacturing at 57.72%. This may indicate that 3D printing or additive manufacturing is moving further into the mainstream and production uses, rather that just rapid prototyping.

Robotic manufacturing slightly overtaking CNC Machining (51.41%) is also of note – and may indicate optimism about the rapid advances in robotics – particularly when advanced AI (which can already hold sophisticated conversations) is paired with the next generation of humanoid robots. While these will not replace dedicated industrial robots on production lines, the idea of multirole robots, that can be conversed with for other manufacturing tasks, may be closer than we think.

There was a change from the 2023 results to the question of ‘How much of your manufacturing is produced in-house?’ with the most popular answer being 25-50% (29.59%) in 2024, down 10% from 2023.

This may reflect respondents being more involved in the upstream R&D phase of advanced manufacturing – where it may make more sense to outsource limited manufacturing runs before investing in factory and tooling. However, this finding seems to contrast with larger trends, such as Boeing now bringing back Spirit AeroSystems in-house and other moves afoot to ‘in-shore’ production, for example in decoupling from China, boosting sovereignty and enhancing national resilience following lessons from Ukraine.

The next question, ‘What do you think are the greatest challenges facing the aerospace industry during their adoption of digital manufacturing techniques?’ saw ‘project costs’ and ‘lack of expertise’ score the highest with 5.34 and 5.02 respectively.

This was similar, but with slightly lower weighting to the 2023 results, and project costs (4) and lack of expertise (4.03) reversed. Projects costs have grown considerably compared to 2023, showing that economic factors are having an impact on implementing new digital manufacturing techniques.

The next question – ‘What percentage of your business’ manufacturing services are automated?’ saw ‘under 25%’ as the most popular choice with 31.44%, followed surprisingly by ‘none’ at 26.32% and then 25-50% in third place with 26.18%. This contrasts significantly with the 2023 survey, where ‘51-75% automated’ was the most popular response with 29.97%, followed by 25-50% automated with 28.65%. Putting aside the wild conclusion that some sort of rapid deindustrialisation of the aerospace sector has taken place over the past year, this would seem to indicate that many respondents in the 2024 survey are more engaged in the R&D end of the manufacturing process, where hands-on rapid prototyping and design are more in use than volume production.

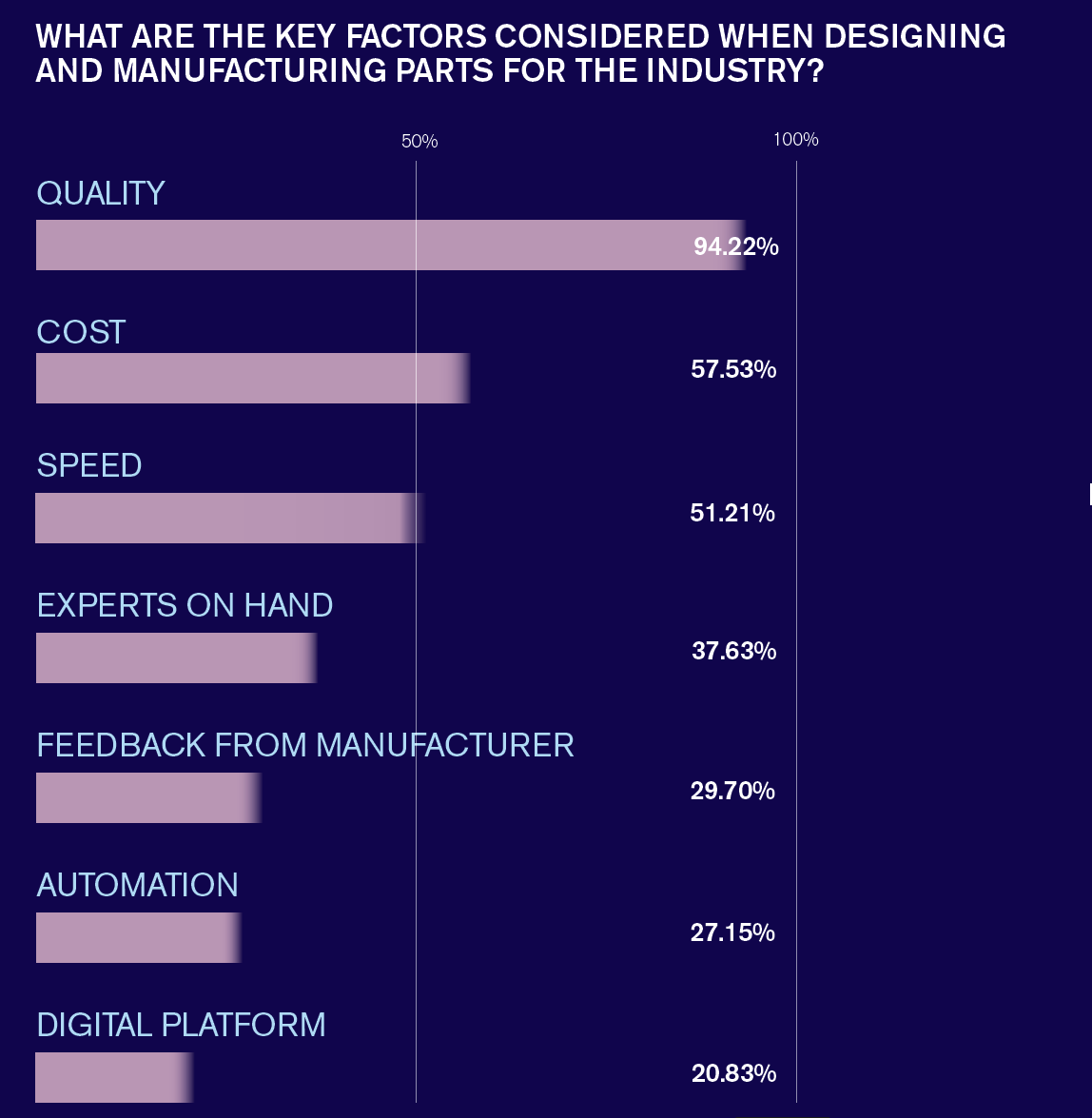

The following question, ‘What are the key factors considered when designing and manufacturing parts for the industry?’ saw ‘quality’ zoom into first place as the clear winner with 94.22% of the votes, trailed by ‘cost’ with 57.53% of responses. This saw a leap of around 30% from 2023 when it was still the number one choice, but was on 64%. In 2023, ‘experts on hand’ took second place, on 43%, which had dropped to 37.63% in 2024. This sharp jump in quality then could be explained by an increased focus on aerospace manufacturing issues over the past year, including Boeing ‘fake parts’ and the quality issues that P&W has encountered with its GTF engines, which have seen airlines ground aircraft. Quality (and the safety guarantees from aerospace grade parts) have always been important but the results indicate that the aerospace sector now perhaps feels it is more under the spotlight for manufacturing issues than in recent times.

Meanwhile, the next question – ‘How important is certification when working with manufacturing partners?’ saw ‘very important’ significantly increase in ranking from 47% in 2023 to 76.12% in 2024, with the next top answer for 2024 being ‘important’ at 20.35%. Again, the boost in the rankings for certification may be explained by aerospace manufacturing coming under closer scrutiny.

Additionally, it is notable that the vanguard of a large ‘advanced air mobility’ sector, which includes eVTOLs, drones and hybrid-electric aircraft is now entering the certification and flight test phase – potentially shifting the results in that direction.

For the next question, ‘Where do you see the aerospace focus in the next 3 years?’ the top result was ‘new technologies’ with 63.36%, narrowly edging out ‘sustainability’ on 60.13% and ‘recruiting more skilled personnel’ on 58.66% - while ramping up civil production post-Covid fell from 47.9% in 2023 to 23.09% in 2024.

While ‘new technologies’ nudging ahead of ‘sustainability’ as the top concern might on one level seem a blow for aviation net zero ambitions, when one considers the history of aviation on the whole, ‘new technologies’ whether it is more efficient engines, improved aerodynamics, lighter-weight materials, or at the factory level, less waste, faster production and more efficiency inevitably mean that these go hand-inhand with sustainability. Viewed through this lens, ‘new technologies’ might in fact be seen as an indication that these sustainable technologies are now set to move from the drawing board or CAD screen to reality and production in the next few years.

On ‘ramping up civil production’, while there are now, undoubtedly, issues in keeping up with the return of airline demand, air traffic in most parts of the world have now returned to pre-2019 levels. Constraints we can see are now from self-inflicted issues (such as Boeing’s ‘quality escapes’) and growth on top of pre-Covid levels. Interestingly, and in line with this finding, recruiting more skilled personnel fell from the number one focus in 2023 to third place in 2024 – suggesting that there are now adequate numbers of personnel who have either rejoined or have been recruited into the aerospace supply chain. Yet, as Boeing’s crisis may indicate and which has already been raised by others, the numbers themselves may not tell the whole story.

An influx of new workers, to replace those experienced staff lost by layoffs, furloughs and retirement during Covid, may present new challenges in transmitting a safety culture. Though the staff numbers are now there, the experience crucially could still be lacking.

In a question later on in the survey when asked ‘What certifications do you believe to be the most important?’ there was strong support for AS9100, EASA, FAA and ISO 9001, as well as more generic answers, like ‘safety’, ‘regulation’ and ‘international certifications’.

Finally, 2024 also introduced a new question into the survey – ‘How important do you think AI will be in advanced manufacturing/digital design in the next 5-10 years?’ ‘Important’ was the top answer, at 48.65%, followed by ‘very important’ at 32.61% and then ‘not so important’ with 16.85% of votes. These results suggested growing confidence in AI in the way it can revolutionise and transform manufacturing, whether it is optimising 3D printing, robotics, or natural language ‘virtual assistants’ to speed up queries.

However, this was hedged with a note of caution in that ‘very important’ was only separated by 16% from ‘important’ suggesting that results had yet to be fully seen. This, undoubtedly, will be an area to keep a close eye on in the future.

Summary

Again, this Protolabs/RAeS survey provides valuable insight into the fast moving and highly dynamic world of aerospace manufacturing – one that, having been rocked by Covid and skills’ shortages, is now grappling to deal with additional demands on certification, oversight and traceability presented by aviation safety headlines over the past 12 months. That said, as well as the return to growth, there are bright spots in the votes for ‘new technologies’ being the top focus in the next few years, and cautious optimism around the role of AI in transforming advanced manufacturing.